Success stories powered by Unifonic: Tabby

Success stories powered by Unifonic: Tabby

Unifonic’s intelligent solutions streamline customer communications and improve fraud mitigation for Tabby

Tabby – a Shopping and Financial Services Provider

In an effort to enable financial freedom in the way people shop, earn, and save, Tabby, established in 2019, offers buy-now-pay-later service for customers to enhance their purchasing power and flexibility, thus reshaping shopping experiences. Through this service, the company offers customers an opportunity to shop their preferred products from their favourite brands and split their purchases into four interest-free instalments, both online and in-store, with zero interest. Headquartered in Riyadh, KSA, Tabby primarily serves the retail industry and has a diverse clientele, ranging from small stores to multinational brands.

Hadeel Ghadri, Customer Experience & Project Manager of Tabby, stated: “Our overarching goal is to empower customers with financial freedom by harnessing the power of flexible payment methods. With many online and in-stores integrating Tabby as a payment option at checkout, we seek to provide an enjoyable and convenient shopping experience for customers without any financial worries.”

Business Goals and Challenges:

Enhancing Customer Experience, Improving Fraud Mitigation, and Maintaining compliance with Saudi Central Bank (SAMA) Regulations

Tabby recognises the significance of customer experience in its business strategy. For that reason, the company relentlessly strives to set forth seamless shopping and financial services that meet the varied needs of customers. The company understands the significance of delivering exceptional service as a cornerstone for developing robust customer relationships, retention, and brand loyalty.

With a steadfast commitment to innovation, as well as reshaping the retail and financial landscape, Tabby’s key objectives include becoming a leading financial services company that offers exceptional customer experiences, complies with the Saudi Central Bank's (SAMA) regulations, and effectively tackles fraud attempts to ensure the safety of users. Despite its novel and innovative approach, the company encountered some challenges:

-

Default Rates – Customers failing to make payments posed a significant threat to Tabby’s financial health and stability.

-

Low Engagement Rates - When using conventional communication channels like email, phone calls, and SMS, only around 25 to 30 percent of consumers responded.

-

Resource Constraints - Human resource constraints made efficient handling of customer queries and follow-ups difficult, especially after business hours.

-

Fraud Attempts - It is required for FinTechs to adopt voice confirmation in addition to OTP authentication to mitigate fraud attempts.

Unifonic’s Solutions to Address Challenges and Ensure Compliance to Improve Safety of Users

In order to tackle these challenges and deliver better outcomes, Tabby collaborated with Unifonic to implement a conversational AI solution that utilises advanced communication technologies. The company also leveraged Unifonic’s voice confirmation tool to ensure compliance with the Saudi Central Bank’s regulations, thereby improving Tabby’s fraud mitigation capabilities. These solutions played an integral role in helping Tabby overcome various obstacles and achieve its strategic objectives.

-

Payment Reminders:

By leveraging Unifonic’s Multichannel Campaigns, Tabby was able to send automated payment reminders to customers through mobile communications, in addition to other channels, assuring extended reach and engagement. Additionally, a mass customised communications and messaging campaign was employed to ensure consistent interactions with each customer, increasing the likelihood of them completing their payment.

-

Conversational Support:

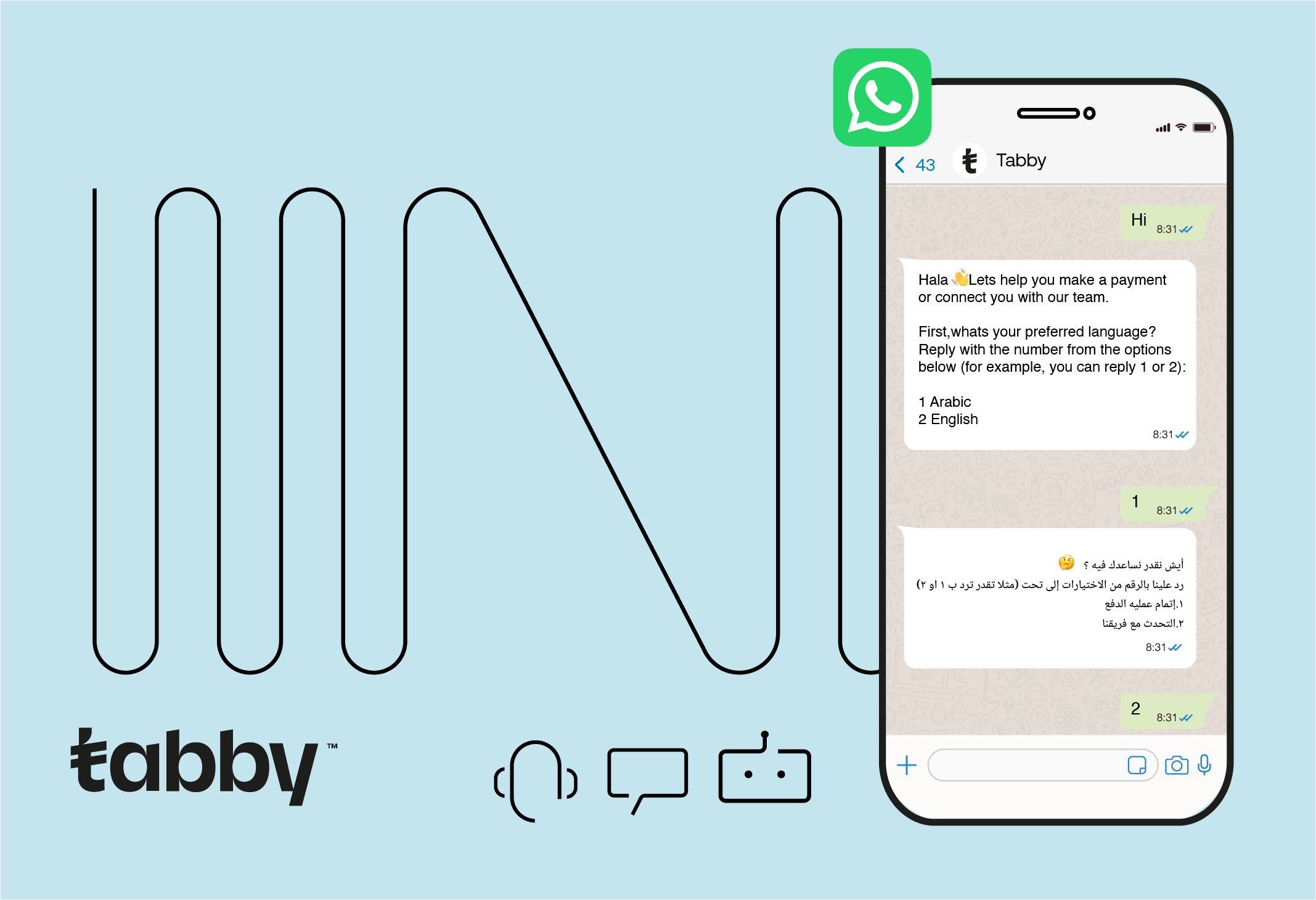

Using Unifonic’s Chatbot Builder further paved the way for improved customer service and convenience with a self-service chatbot to handle common inquiries and provide payment options. By integrating the Unifonic Agent Console, complex customer concerns are easily escalated from chatbots to human agents, thus combining efficiency and personalized attention.

-

Voice Confirmations:

In order to meet the Central Bank’s requirements, Tabby had to set up a reliable way to verify purchases made through their payments services through automated calls, guaranteeing a smooth verification process of the identity and intentions of the customer.

By providing crucial information about the products and their associated costs, Unifonic's voice confirmation solution promoted clear communication and made it simple for customers to accept or reject their purchases using button prompts. By securing the checkout experience, and reducing the compliance burden, Tabby is now able to effectively navigate the complexities of regulatory requirements in the region, while mitigating fraud attempts. Ultimately, the collaboration improved Tabby's operational effectiveness and security in addition guaranteeing complete compliance with regional laws, giving them a competitive edge in a dynamic market.

Mahendra Gurjar, Data Analyst at Tabby, said: “By closely monitoring conversation statuses and response timings, we are able to utilise effective data analytics to improve customer satisfaction and ensure that every user feels valued, especially those who reach out after hours. It was noticed that around 10 percent of customers who did not respond to payment reminders via other channels responded to those received through mobile communications. Customers who respond to the communication campaign will also receive a chatbot response with multiple options, such as to connect with an agent or make payments. Our collection team uses the tool to remind customers of their payments, resulting in a major shift within our operations. By adhering to the Central Bank’s regulations, we were also able to put in place a reliable process that guarantees smooth purchase confirmation, which thereby lowers fraud attempts and guarantees user safety.”

Results

With Unifonic’s advanced range of solutions, customer engagement and operational efficiency were both significantly improved.This collaboration also enabled Tabby to effectively navigate the complexities of regulatory requirements in the region, ensuring compliance with the Saudi Central Bank’s regulations while mitigating fraud attempts. As a result, Tabby enhanced its operational effectiveness, bolstered security, and achieved seamless integration with regional laws. This not only streamlined their processes but also provided a competitive edge, positioning Tabby to thrive in a dynamic and fast-evolving market.

-

Enhanced Collection Rates - By utilising several channels for communication, Tabby observed a notable rise in response rates. Remarkably, 10 per cent of customers who had not replied to reminders before started engaging and responding when contacted over mobile communications.

-

Improved Customer Experience - With prompt reminders, as well as interactive services and conversations, the automated and tailored communication strategy guaranteed a seamless customer experience.

-

Resource Optimisation - By relieving collection agents of routine tasks and enabling them to focus on other relevant concerns and issues, Unifonic improved productivity and quality of the services provided.

-

After-hours Payments – Tabby was able to collect payments effectively even outside of regular business hours, owing to the self-service features that enabled after-hours payments.

-

Regulatory Compliance & Fraud Mitigation - Unifonic’s voice confirmations solution has enabled Tabby to have a reliable purchase verification process in place, which lowers fraud attempts, guarantees user safety & aligns with regulatory requirements.

Hadeel Ghadri, Customer experience & Project Manager of Tabby, stated: “Our partnership with Unifonic will only get stronger, especially in light of their proactive inclusion of our requests into their roadmap, and unwavering commitment to providing exceptional support. The objectives of this partnership perfectly align with our business goals, and we look forward to further streamlining operations as we move forward.”

Thanks to Unifonic's customised solutions, Tabby addressed its existing challenges and was able to improve customer engagement, improve fraud mitigation, and transform the overall business performance within the buy-now-pay-later fintech segment.

Related articles

13 March 2024

Why Customer Experience is the Key to Banking Success

Read more