Why Customer Experience is the Key to Banking Success

Why Customer Experience is the Key to Banking Success

It can be tempting to think about new technology as solely a way of streamlining operations and cutting costs. That’s an entirely valid motive for any business, but it overlooks another major benefit: improving the customer experience. CX is one of the key ways to compete in every sector, none more so than in banking and finance, because it can boost revenue and customer retention. Here’s what you need to know.

Setting the Scene

Let’s start by looking at the banking and payments sector in the Middle East to see why the digital experience is such an important element. In this context, “banking and payments” includes traditional and digital banks, digital assets and fintech, and the associated regulatory technology.

Across the Middle East and Africa as a whole, credit cards are the most popular form of e-commerce payment, making up around a third of transactions. That’s not expected to change in the coming years. However, digital payments and mobile wallets are forecast to take a clear second place, rising from 17% of transactions in 2021 to 26% in 2025. That’s largely at the expense of physical payment methods such as cash-on-delivery, which is forecast to slump to just 7% of transactions.

Saudi Arabia & UAE

Within this wider context, Saudi Arabia and the UAE are standouts. By 2027, the vast majority of the adult population in the two countries is expected to use digital payments in some form. Meanwhile, online banking looks set to continue impressive growth. Saudi Arabia recently reached the point where half of the population uses online banking, which is expected to rise to 68% by 2028. The kingdom already has the third-highest proportion of users across the Middle East and North Africa, behind only the UAE.

There’s still some significant room for growth, though. Only 24% of the population of Saudi Arabia uses an online banking site or app at least once a month, while 28% use a mobile payment service monthly. This suggests that something is putting users off making the most of their access to such services.

The other most notable trend in the sector is fraud. Simply put, it’s happening more often, with a higher average loss per case, and a lower proportion of funds recovered. Transparency and security, therefore, are key to winning and retaining customer confidence

The Customer Experience

There’s a clear shortfall between people in the region with access to online banking tools and people taking full advantage. At Unifonic, we believe the customer experience explains some of that shortfall.

A recent study found that 13% of banking customers who start a digital interaction not only find they can’t complete a desired task but give up completely. They don’t or won’t move to a different channel (such as phone banking or a visit to a physical bank visit) to try again.

Not only does that risk banking and finance companies missing out on an interaction that could have generated revenue, but it can mean losing customers altogether. While some banks compete on cost, a reported 81% of banks compete mainly on the customer experience.

The Online Element

Competing on experience is even more significant online. With in-person banking declining, people think less about the bank as an institution and more about their user experience and individual transactions or tasks.

The key word is “seamless”. Customers don’t want to see barriers and distinctions between interactions they have with a bank through different channels, they want the same level and breadth of service they would get at a physical branch but with the convenience of accessing services through their devices. Customers today demand a single, secure, and easy experience regardless of the channel they choose to interact through. Such an approach is key for the banking or finance company to engage customers effectively, carry out services, boost security, track fraud, and remain compliant with government regulations.

Unifonic’s Solutions

-3.png?width=458&height=512&name=unnamed%20(3)-3.png)

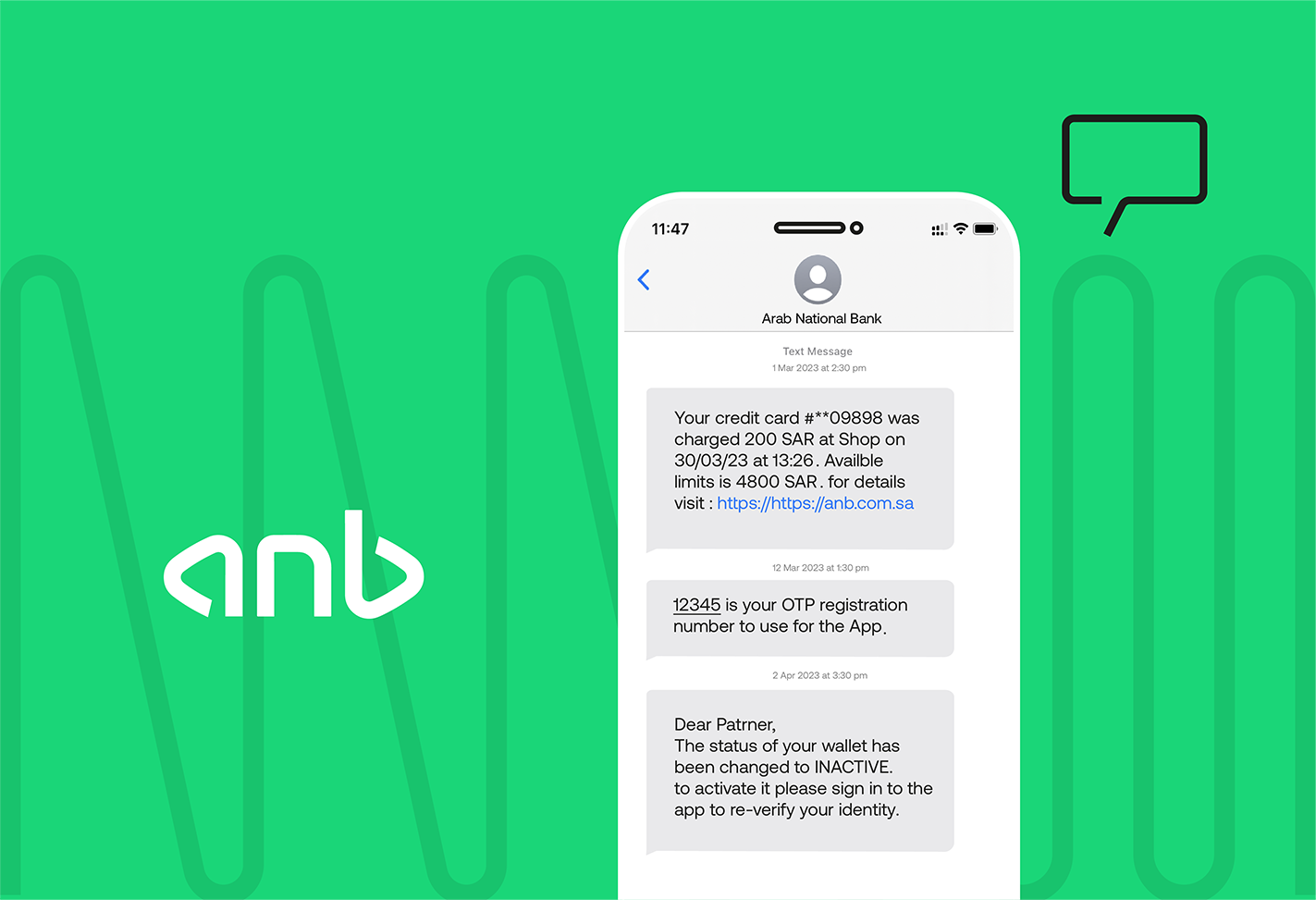

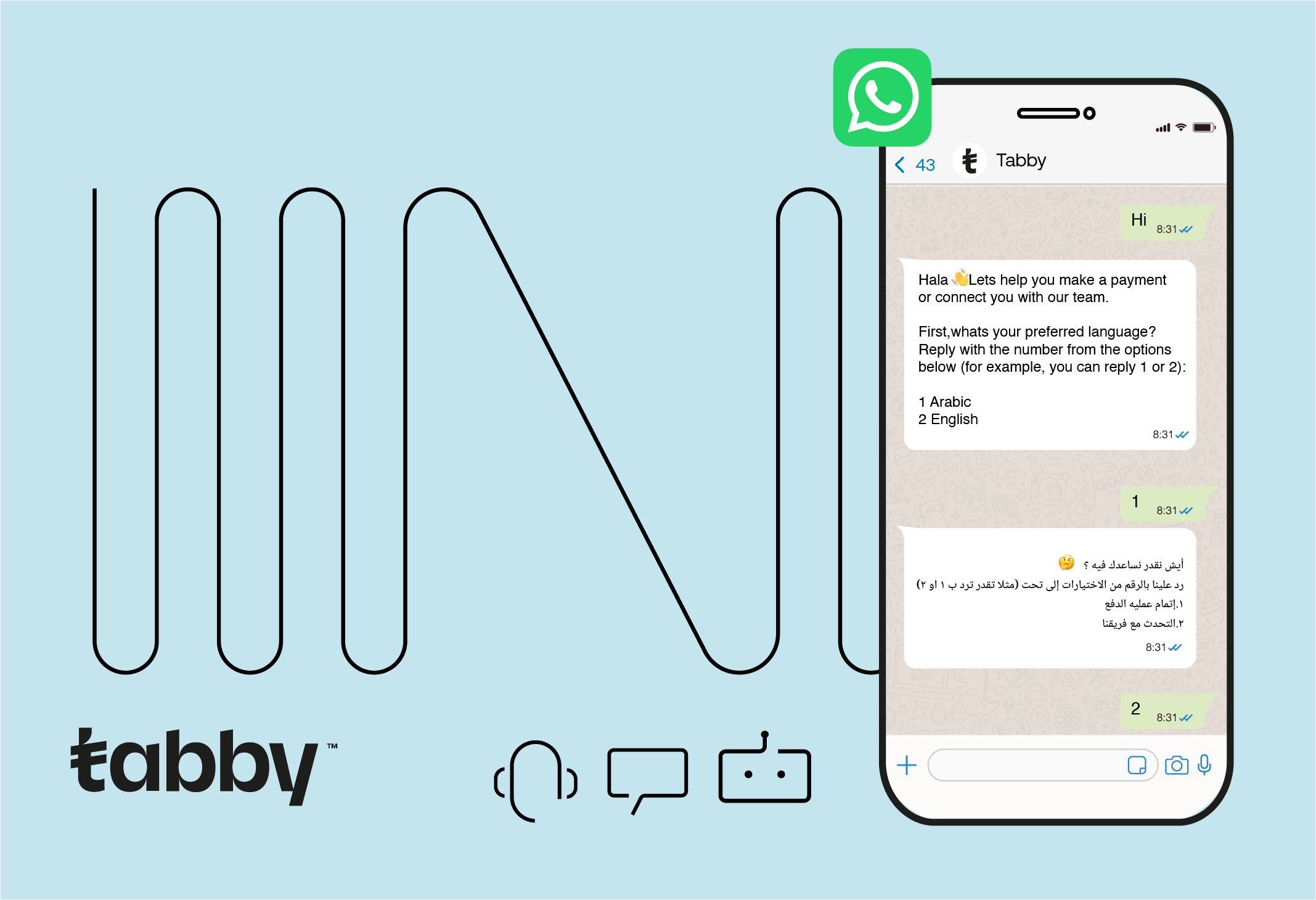

Unifonic can help banks offer this streamlined, consistent service through its range of tools for WhatsApp, SMS, webchat, or social media messaging. A combination of automated responses and natural language chatbots allow customers to carry out the vast majority of their banking activities through their preferred messaging channel. Unifonic’s authentication and verification features make customers feel safe and keep your operations secure and compliant.

This produces a personalized “omnichannel” experience that hits key areas to improve customer service:

- Secure and compliant financial communication.

- Customers feel informed and empowered.

- Communicating in natural language.

- An uninterrupted process across devices and conversations.

- Instant responses with a clear timeframe for resolutions

- Reduced waiting times.

For a closer look at how Unifonic customers like Circlys and ANB have used our products to improve their customer experience, you can read their success stories here.

The Technology

Unifonic’s no code or low code approach and API access make it easier for banks and financial institutions to build their multi-channel services and to quickly deploy solutions. The Unifonic tools include a Chatbot Builder and Flow Studio, making it easier to build communication journeys, with no code required, and integrate the customer communications channels with the bank’s software, databases, and systems.

The chatbots can use a pre-defined series of questions, answers, and trigger phrases; use natural language analysis for a more conversational approach; and can seamlessly hand over to a human agent if the situation calls for it,

What Can It Do?

The beauty of Unifonic’s Multi-channel approach is that it can work at every stage of the customer experience, including acquiring, engaging, and supporting customers. This can include everything from payment reminders to branch finder tools based on device location.

To give one example of the integration, imagine a customer interested in taking out a personal loan. They can initiate an inquiry through a WhatsApp chat, with either trigger words or natural language analysis identifying the customer’s request.

The automated response could then provide relevant information such as current interest rates and explain the application process, it could then ask for permission to run a credit score check, carry out the check, and send a push notification with a link to make the loan application, with relevant details pre-filled. While this may involve several different systems and tech setups for the bank, it’s a seamless, continuous experience for the user.

Security and Compliance

In the banking and finance sector, nothing is more important than security and compliance, after all, we are talking about handling and safeguarding people’s hard-earned money. With fraud on the rise and cyber-attacks becoming more and more sophisticated, security is paramount and government regulations are thankfully becoming more and more robust.

In all Unifonic solutions, Internationally recognized cybersecurity standards and best practices are meticulously followed, including ISO 27001, ISO 27017, ISO 27018, CSA STAR Level 2, and SOC 2 Type I and II. These certifications and best practices ensure alignment with global ISO standards and reflect our commitment to meeting regulatory requirements.

Although these international standards are very robust, we also understand that banking regulations vary from country to country, meaning that the information you can provide, share, or collect through instant messaging or a banking app will vary. For example in KSA, The Saudi Central Bank (SAMA) has defined a set of compliance controls that must be adopted and implemented by member organizations to maintain adequate protection of information assets and digital services. This subject is discussed in depth in our previous article.

Unifonic’s solution is easily customizable to comply with local security regulations. For instance, it’s straightforward to set up a system that handles the information exchange for a credit application but triggers an automated voice call to get spoken consent to access credit records or proceed with the application.

The Bottom Line

The user experience is one of, if not the, most important reasons customers stick with a banking or payments business. A frustrating or disjointed experience can help drive customers away or discourage them from taking full advantage of your services.

Unifonic’s approach combines the simplicity and popularity of WhatsApp, SMS, webchat, and social media messaging apps with powerful but easy-to-use tools to help you offer the seamless, integrated service your customers demand. Contact us today to find out more.

Related articles

11 March 2025

Success stories powered by Unifonic: Tabby

Read more